GetSetHome

31 December 2025

A Quiet Compounder

in

Co-living

When we first met the GetSetHome team six years ago,

co-living in India was having its big, loud moment. Everyone wanted in. Startups were raising staggering rounds, locking in thousands of beds, and racing to blitz-scale across cities. The playbook looked familiar — rent massive real estate blocks, standardize them, scale fast, and ride the wave of millennial migration.

But while others chased the noise, GetSetHome (GSH) chose a quieter, more deliberate path. Not just in what they built, but in what they believed.

They weren't chasing vanity metrics.

They weren't burning cash to grow.

They were building something sturdier — a business where the math worked before the story did.

Their belief was simple yet radical for the time: India's urban rental experience was broken for both tenants and landlords. GSH set out to fix it through a tech-enabled, decentralized, and asset-light model that made living more human and ownership more profitable.

The Co-Living Mirage

For years, co-living was described as the “WeWork of housing.” It sounded logical — take large real estate blocks, standardize them, and scale across cities. Millions of young professionals and students migrate every year in search of homes that are safe, flexible, and affordable. But the reality they found was often bleak — fragmented listings, unaccountable brokers, and homes that lacked even basic convenience.

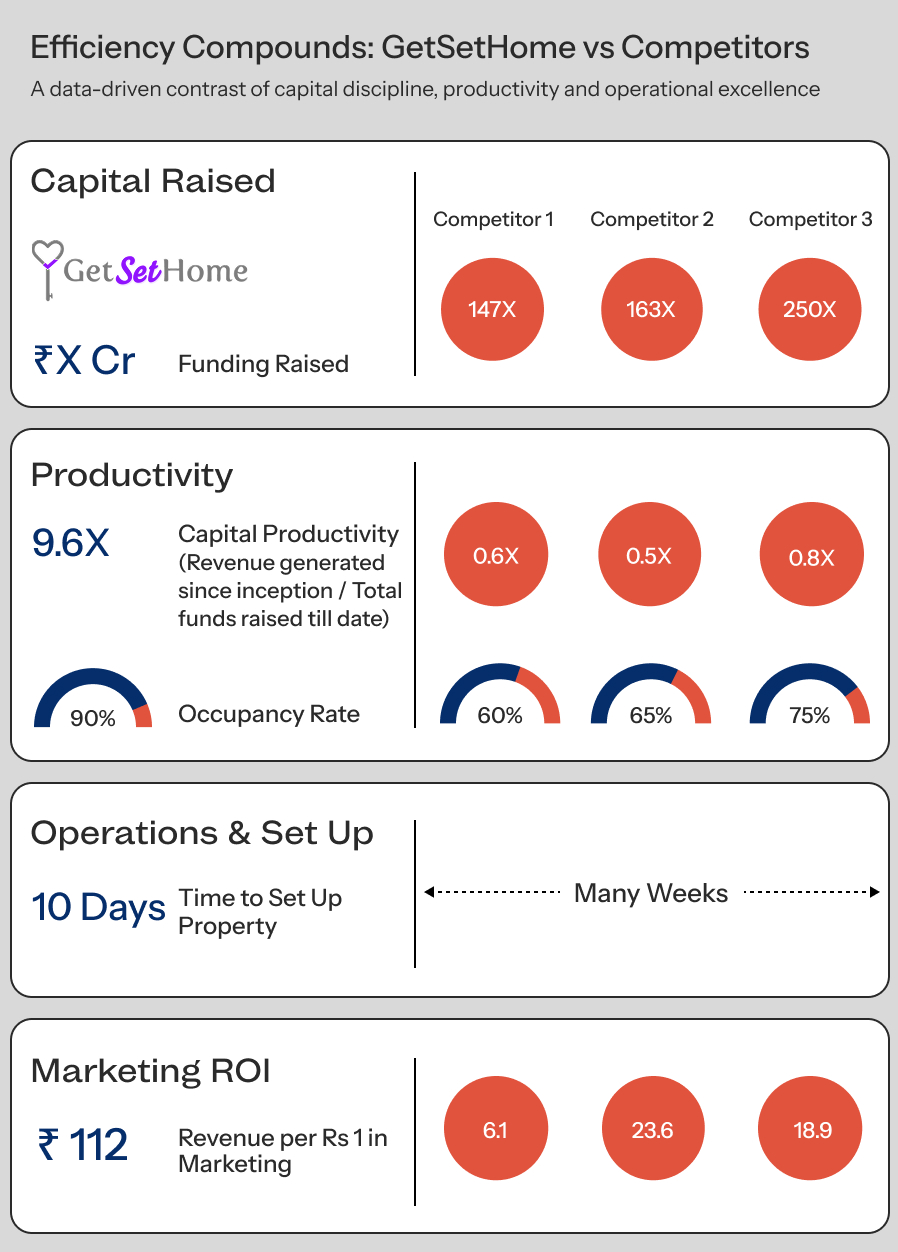

Most new-age players entering the space looked westward for inspiration. They imported global playbooks built on centralized inventory, long leases, and aggressive expansion. What followed was predictable — high growth on paper, but low margins in practice. Heavy capital expenditure, endless marketing spends, and mounting occupancy risk. Many of these “unicorn hopefuls” raised over 100 million dollars each, only to find themselves bleeding cash and losing ground.

Because India, as always, plays by its own rules. Inventory is fragmented. Leases are expensive. Supply is hyper-local. And tenants value flexibility more than frills.

Turning the Model Inside Out

GSH saw this early and inverted the model entirely. Instead of chasing mega properties, they began aggregating scattered units — apartments, bungalows, and homes — located close to where demand already existed: IT parks, education clusters, and transit nodes. Each property was fully managed and plug-and-play, designed for comfort and convenience.

Behind the scenes, a proprietary full-stack tech platform powered everything — from operations and maintenance to tenant experience, demand forecasting, and expansion planning. Machine learning helped them identify the right neighbourhoods, optimize costs, and maintain visibility across their distributed network.

Their approach made them incredibly nimble. GSH could onboard and go live in new properties in about ten days — no heavy setup, no long lock-ins. This agility allowed them to keep costs low and margins healthy while improving rental yields for property owners from a typical 2% to an impressive 6%.

In an industry addicted to scale at any cost, GSH quietly proved that profit and growth could coexist.

Why We Invested: A Contrarian Bet

Our investment in GetSetHome stemmed from three convictions.

First, the urban rental experience in India was fundamentally broken — crying out for a full-stack solution that worked for both tenants and landlords.

Second, decentralization, when powered by technology, was not a limitation but an advantage — allowing faster setup, lower fixed costs, and greater resilience.

And Third, capital efficiency would eventually win. In consumer real estate, as in every category, sustainable margins and strong unit economics would always outlast rapid, loss-fuelled growth.

GetSetHome embodied that philosophy from day one. They built discipline into their DNA, choosing to scale only when it made financial sense. While others built for valuation, they built for value. And that difference — quiet, consistent, capital-efficient execution — has made all the difference.

The Quiet Growth Story

What stood out to us back then—and continues to compound today—is how, while funded peers chased scale with significant burn, GSH quietly built a strong, sustainable business. An average revenue run rate of ₹195 million, over 90% occupancy, and gross margins of around 35%.

Along the way, it helped more than 12,000 individuals secure accommodation and expanded its footprint across five cities—Mumbai, Pune, Navi Mumbai, Chennai, and Indore.

With less than a million dollars in capital raised, GSH's journey remains a masterclass in restraint — clear proof that smart, disciplined growth can create enduring value.

What's Next

Urban migration is not slowing down — it's shifting. Tier-2 cities like Coimbatore, Indore, and Jaipur are becoming vibrant demand hubs, driven by education, IT, and a younger, more mobile workforce. And here, too, GSH's model fits perfectly.

Their decentralized, tech-led approach allows them to enter these micro-markets profitably — without the burden of heavy leases or fixed infrastructure. This is not a business that needs blitz-scaling; it's one that compounds quietly over time.

As more professionals and students move toward flexible living, the demand for reliable, affordable urban housing will only grow.

We're proud to have partnered early with Shabnam, Muddassar, and Junaid — a founding team that combines sharp execution with rare discipline. They are building not just a company, but a category that proves you can grow fast without burning out.

In a space where most chased valuation, GetSetHome built value.

And that, for us, is what long-term venture investing is truly about.